FAQ

Understanding the Risks of Bond Mutual Funds: Are They Right for Me?

I. Are Bond Mutual Funds Right for Me?

Is bond mutual fund investing right for me?

Bond mutual funds—like all mutual funds—involve investment risk, including the possible loss of principal. A fundamental principle of investing known as the risk/reward tradeoff means that when you make an informed decision to assume some risk, you also create the opportunity for reward. Investors should be aware of the risks and potential for losses associated with bond mutual fund investing.

How do the risks and returns of bond mutual funds compare with those of other investments?

Investing in bond mutual funds usually entails less risk—and less reward—than investing in stock mutual funds. Similarly, bank accounts and money market funds entail less risk and less reward than do bond mutual funds. Bank deposit accounts, such as savings accounts or certificates of deposit, are insured against loss up to certain levels by the Federal Deposit Insurance Corporation (FDIC). Money market funds invest in very short-term, high-quality securities and attempt to maintain a constant share price (value). However, an investment in a money market fund is not insured or guaranteed by the FDIC or any other government agency, and it is possible to lose money in a money market fund.

Can a bond mutual fund be guaranteed?

There are no guarantees when investing in a bond mutual fund. Even if the individual bonds in the fund are guaranteed by the government or insured through a private insurer, the value of a bond mutual fund investment can still rise or fall. Bond mutual funds are not insured or guaranteed by FDIC, the U.S. Securities Investor Protection Corporation (SIPC), or by any other government agency, regardless of how a bond mutual fund is purchased or sold—whether through a brokerage firm, bank, insurance agency, financial planning firm, or directly. Nor are they guaranteed by the bank, brokerage firm, or other financial institution where they are sold.

What risks do investors in bond mutual funds face?

Bond mutual fund investing involves four types of risk: interest rate risk, credit risk, prepayment risk, and inflation risk.

How does interest rate risk affect a bond’s value?

Interest rate risk is the possibility that a bond’s price will change due to a change in prevailing interest rates. Bond prices are closely related to interest rates. When interest rates go up, most bond prices go down. When interest rates go down, bond prices go up.

Interest rate risk is commonly measured by a bond’s duration. Duration is a measure of the sensitivity of a bond’s price to interest rate movements. A bond’s duration depends heavily on the remaining maturity of the bond and is often expressed in years.

In general, the longer a bond’s remaining maturity, the higher its duration will be and the more its price will tend to fluctuate as interest rates change. For example, a bond with 20 years left to maturity will have a higher duration than an otherwise equivalent bond with 10 years left to maturity. Consequently, a rise in interest rates will cause a larger drop in price for the bond with the higher duration. However, while longer-term bonds tend to fluctuate in value more than shorter-term bonds, they also tend to have higher yields as a result of this risk.

Can you provide an example of the impact of interest rate changes on a bond’s value?

Let’s say an investor today buys a newly issued bond that pays a fixed 5 percent in interest each year for a total of 30 years. The maturity of this bond is 30 years. The duration of this bond, however, is about 16 years. The duration of the bond is less than the maturity because the investor will receive cash in the form of interest payments during the life of the bond.

If interest rates were to change tomorrow, the duration tells us how much the investor should expect the price of the bond to change in the opposite direction. For example, an increase of 1 percentage point in prevailing interest rates would lower the price of this bond by 16 percent. The bond is worth less because other investors are now able to purchase bonds that are paying 6 percent in interest each year. The bond that is paying 5 percent is less attractive to investors and as such must have a lower price to induce investors to buy it. The opposite is true when interest rates decline. In our example, if interest rates were to decrease by 1 percentage point, the price of the investor’s bond would be expected to rise by 16 percent.

The bond would pay more in interest payments (5 percent) than what the current market offers (4 percent), and the bond’s owner would receive a higher price for the bond if he or she were to sell it.

What is credit risk?

Credit risk refers to the creditworthiness of the bond issuer and its expected ability to make timely interest payments and to pay the face value of the bond at maturity. If a bond issuer is unable to repay principal or interest on time, the bond is said to be in default. A decline in an issuer’s credit rating, or creditworthiness, will cause the prices of its bonds to decline and may cause the share prices of a fund that holds the issuer’s bonds to decline as well.

An issuer’s creditworthiness is usually expressed in terms of bond credit ratings issued by one or more credit rating agencies. The following chart shows bond ratings used by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation (S&P) from highest credit quality to lowest credit quality.

| Moody’s | S&P | Quality Rating |

| Aaa | AAA | Prime Investment Grade |

| Aa | AA | High Investment Grade |

| A1 | A+ | Upper Medium Investment Grade |

| A2 | A | Upper Medium Investment Grade |

| A3 | A- | Medium Investment Grade |

| Baa1 | BBB+ | Medium Investment Grade |

| Baa2 | BBB | Lower Medium Investment Grade |

| Baa3 | BBB- | Lower Medium Investment Grade |

| Ba | BB | Non-Investment Grade (Speculative) |

| B | B | Highly Speculative |

| Caa | CCC | Extremely Speculative |

| C | D | In default |

What is prepayment risk?

Prepayment risk is the possibility that a bond owner will receive his or her principal investment back from the issuer prior to the bond’s maturity date. This can happen when interest rates fall and an existing bond is yielding above-market rates. Borrowers will often issue bonds or obtain loans at the new lower interest rates and use the proceeds to prepay other debt with higher interest rates. For example, firms generally issue bonds when interest rates decline in order to have funds available to pay off callable bonds at their next call date. A callable bond allows the issuer to retain the right to redeem the bond before its stated maturity date. A noncallable bond does not have this buyback privilege. As a consequence of the prepayment, the bondholder will not receive any more above-market interest payments from the investment. Prepayment also forces investors to reinvest their funds in a market where prevailing interest rates are lower than the rates paid by the prepaid bond. Nevertheless, firms issuing callable bonds generally pay higher interest rates for the right to call (prepay) the bond at a future date.

Prepayment risk is most prevalent in bond mutual funds that invest in mortgage-backed debt securities, such as Government National Mortgage Association (GNMA or Ginnie Mae) funds. Bonds backed by home mortgages tend to have high prepayment rates because homeowners often refinance (prepay) their home mortgages when interest decline. Mortgage-backed bonds typically pay a higher yield to compensate investors for this prepayment risk.

What is inflation risk?

Inflation risk is the danger that an increase in price levels will undermine the purchasing power of a bond’s fixed interest payments.

Investors often are attracted to bond mutual funds because of their regular payouts from interest earnings. These payouts, however, can be subject to inflation risk. Inflation erodes the purchasing power of any investment. It is particularly worrisome for investments that pay out a fixed stream of interest over a period of time, such as bonds or certificates of deposits. As inflation increases the prices of goods and services, investors find that their interest earnings are not keeping pace.

For example, suppose $10,000 in a bond earns 5 percent interest, but inflation is 2 percent per year. Although this bond will earn $500 in interest every year, inflation will make goods and services progressively more expensive. Initially, the $500 in interest will buy a certain amount of goods and services (a basket). After a year, that same basket will cost $510 because of inflation, but the investor will still only receive $500 in interest earnings. Year after year as prices rise, the same $500 in interest earnings will buy fewer and fewer goods and services. This is what is meant by inflation eroding the purchasing power of an investment. The longer a bond’s maturity, the greater its inflation risk. Bond yields often incorporate expectations of inflation so that investors are compensated for expected inflation risk. If inflation rises by more than was expected when the bond was issued, investors will find that the interest and principal returned to them will be worth less than they had anticipated.

II. Background on Bond Mutual Funds

What is a bond mutual fund?

A bond mutual fund is an investment company created to manage an investment portfolio consisting primarily of individual bonds. Investors purchase shares in the fund. Each share represents a proportional ownership interest in the pool of bonds comprising the fund’s portfolio.

How does a bond mutual fund work?

Professional money managers use the money invested by shareholders to buy and sell bonds for the portfolio in accordance with the fund’s investment objective. By pooling their resources, bond mutual fund shareholders can invest in a greater number and variety of bonds than they could invest in individually. Many bond mutual funds have minimum investments that are significantly less than the principal value of many individual bonds. For example, a single Ginnie Mae bond may cost $25,000 or more, but an individual can invest in most GNMA bond mutual funds with only $1,000.

What are the different classifications of bonds that bond mutual funds invest in?

Bonds typically are classified in three ways: by issuer, maturity, and quality. Bond mutual funds may invest in one or some combination of these types of bonds.

Types of Issuers. The U.S. government sells bonds through the Treasury to finance the national debt and through various federal agencies for special purposes. State and local governments sell bonds to finance projects such as schools, hospitals, highways, bridges, and airports. Corporations sell bonds for various purposes, such as to finance new factories and offices or buy new equipment.

Maturity. Maturity refers to the length of time until the principal value of the bond is due to be repaid. Short-term bonds generally mature in two years or less. Long-term bonds mature in more than 10 years. Intermediate-term bonds, as the name implies, mature between short- and long-term debt. In general, the longer a bond’s maturity is, the greater its interest rate risk.

Quality. Quality refers to the “creditworthiness” of the issuer; in other words, the likelihood that it will be able to make periodic interest payments and repay the principal when the bond matures. Independent rating services, such as Moody’s Investors Service, Inc. or Standard & Poor’s Corporation, publish directories (available in most large libraries and on the Internet) that rate bond quality. A lower rating means the service associates a greater credit risk with that particular bond issuer.

What are the components of a bond mutual fund’s return?

A bond mutual fund’s investment return, known as its “total return,” is composed of three components: the fund’s yield, its capital gains distributions, and changes in the value of fund shares.

What is a bond mutual fund’s yield?

Interest earned on the bonds held in the fund’s portfolio is passed through to the funds’ investors as dividends. These dividends can be taken in cash or reinvested in the fund. This component of a bond mutual fund’s return, less fund expenses, is called its yield. A fund’s yield is expressed as a percentage of the maximum offering price per share on a specific date.

What determines a bond mutual fund’s yield?

Two major factors affecting a bond mutual fund’s yield are the quality and maturity of the bonds in the fund’s portfolio. In general, bonds with lower quality and longer maturities entail greater risk, and so offer higher yields.

Yield—the amount of interest the fund is generating—is only part of the story. In fact, it may be possible for price depreciation to completely offset or even exceed income earned.

How do bond mutual funds generate capital gains distributions?

The prices of bonds held in a bond mutual fund’s portfolio may fluctuate as a result of changes in prevailing interest rates and the issuers’ creditworthiness. When a fund sells bonds whose prices have changed, the sales generate capital gains or losses. When gains from these sales exceed losses, they are distributed to shareholders as capital gains distributions. These distributions can be paid out in cash or reinvested in the fund. When losses exceed gains, the bond mutual fund’s share price will decline.

Why does the value of a bond mutual fund’s shares fluctuate?

Like all mutual funds, a bond mutual fund must recognize changes in the prices of all the securities held in its portfolio by calculating their market values, usually daily. Day-to-day changes in the value of the fund’s portfolio securities are reflected in the net asset value (NAV) of fund shares.

To calculate the total return of a bond mutual fund, one must include any change in the fund’s share price or NAV, along with any income earned through dividends and capital gain distributions.

How many bond mutual funds are there?

Bond mutual funds are the second most common type of mutual fund, accounting for 1,848 of the 7,677 mutual funds as of February 2010, according to ICI’s monthly survey of the U.S. fund industry.

Who owns bond mutual funds?

Bond mutual funds have become an important way for U.S. households to invest in the bond market. Among households that owned mutual funds in 2009, about half owned at least one bond mutual fund. Like most mutual fund shareholders, bond mutual fund investors usually own more than one type of mutual fund: 88 percent of all bond mutual fund shareholders also own stock funds. Bond mutual funds are particularly popular with retirees and older Americans.

III. Trends and Statistics About Bond Mutual Fund Investing

How much money currently is held in bond mutual funds compared to stock, money market, and hybrid mutual funds?

As of February 2010, 21 percent—or $2.3 trillion—of total mutual fund assets are invested in bond mutual funds. For comparison, stock funds account for 44 percent ($4.9 trillion), money market funds comprise 29 percent ($3.1 trillion), and hybrid mutual funds make up 6 percent ($645 billion) of mutual fund assets.

How big are bond mutual fund holdings relative to the U.S. bond markets?

As of year-end 2009, bond mutual funds held 16 percent of the $2.8 trillion in municipal government debt. Furthermore, bond mutual funds held 7 percent of the $11.5 trillion in corporate and foreign debt, and held 5 percent of the $15.9 trillion in federal government and agency debt.

What are recent bond mutual fund flow trends?

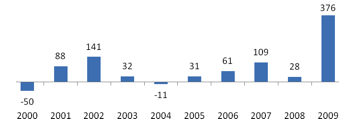

In 2009, net flows to bond mutual funds totaled a record $376 billion. In 2008, bond mutual funds experienced inflows of $28 billion. In 2007, bond mutual funds had an inflow of $109 billion.

Net New Cash Flow to Bond Mutual Funds

Billions of dollars, 2000-2009

I’ve heard that lots of people invested in bond mutual funds from 2005 through 2009. Can you explain what happened and why?

The increase in bond mutual fund investment that started in 2005 can be traced to a number of factors, but it’s difficult to assign weights to determine which of these factors had the most impact. These factors can be broken into two categories—cyclical and secular:

Cyclical

- Economic factors. Cash flow into bond mutual funds is highly correlated with the performance of bonds. The decline in interest rates in 2009 pushed annual returns on corporate bonds to 19 percent for non-prime investment grade bonds and to 58 percent for speculative bonds. In addition, low short-term interest rates and the relatively steep yield curve likely enticed some investors to shift out of money market funds—whose yields hovered just above zero— and into short-term bond mutual funds.

Secular

- Demographic factors. As the Baby Boomers age, and the leading edge of this group already has started to retire, they have allocated their investments increasingly to fixed income securities. Bond mutual fund inflows since 2004 have been stronger than can be explained by cyclical demand, suggesting that flows could be driven by a longer-term demographic shift in investment.

- Risk tolerance. U.S. household surveys show that in recent years, households’ tolerance for investment risk has dropped. One factor that may partly explain this development is that investors have recently endured two of the worst bear markets in stocks since the Great Depression.

- Target date fund automatic allocation. Target date funds—funds that automatically allocate investors’ funds among various asset classes and adjust that allocation as investors approach retirement age—have grown in use and popularity in the last decade. These funds’ allocations have led to an increased demand for bond mutual funds.

Could the current strong demand for bond mutual funds fade?

There are already signs that the cyclical demand may be slowing and the large positive returns in bond mutual funds may be nearing the end stage of this cycle. It’s difficult to say when the cycle will end. The Federal Reserve has already bumped up the discount rate—the interest rate it charges on loans to commercial banks and other depository institutions—and will begin to increase the federal funds rate at some point, which will mean lower returns in bond mutual funds if intermediate- and long-term interest rates follow suit. Indeed, bond returns could even become negative as they did during 1994–1995 when the Federal Reserve ratcheted up short-term interest rates and intermediate- and long-term interest rates also increased.

April 2010