Target Date Funds Expand in 401(k) Plans

Target Date Fund Use Varies Across 401(k) Participant Ages

Washington, DC, December 23, 2013 — A greater number of 401(k) plan participants are investing in target date funds over time. At year-end 2012, 41 percent of 401(k) participants held target date funds, according to a report released today by the Investment Company Institute (ICI) and the Employee Benefit Research Institute (EBRI).

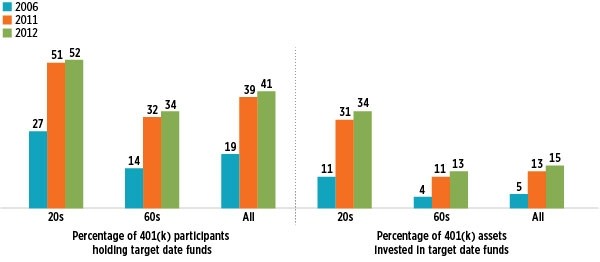

The 41 percent of 401(k) participants who held target date funds at year-end 2012 represents an increase from 39 percent in 2011 and 19 percent in 2006. In addition, 15 percent of the assets in the EBRI/ICI 401(k) database were invested in target date funds at year-end 2012, up from 13 percent in 2011 and 5 percent in 2006.

The report, “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2012,” finds that the use of target date funds for retirement savings is expanding. These funds, also known as lifecycle funds, are designed to offer a diversified portfolio that automatically rebalances to be more focused on income over time.

401(k) Investors Stick with Equity Investments

At year-end 2012, 61 percent of 401(k) plan participants’ accounts were invested in equities—through equity funds, the equity portion of target date funds, the equity portion of non–target date balanced funds, and company stock. The report shows younger 401(k) plan participants had higher concentrations in equities—nearly three-quarters of 401(k) assets among participants in their twenties or thirties—compared with older participants. Participants in their sixties had less than half of their 401(k) assets invested in equities.

“Fears that retirement savers would abandon equities in the wake of the financial crisis have not been borne out by the data,” said Sarah Holden, ICI senior director of retirement and investor research. “And, target date funds are playing an important role for 401(k) investors, particularly for younger participants, by maintaining age-appropriate concentrations in equities.”

Target date fund use varies across 401(k) participant age. As the figure below shows, younger participants are more likely to hold target date funds and target date funds represent a much larger share of their 401(k) assets. At year-end 2012, 52 percent of 401(k) plan participants in their twenties had target date funds, and those funds made up 34 percent of their 401(k) assets.

Role of Target Date Fund Investing in 401(k) Plans

By participant age, selected age groups, selected years

Note: Funds include mutual funds, bank collective trusts, life insurance separate accounts, and other pooled products.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

"More new or recent hires invested their 401(k) assets in balanced funds, including target date funds,” notes Jack VanDerhei, EBRI research director. “At year-end 2012, nearly 54 percent of the account balances of recently hired participants in their twenties was invested in balanced funds, compared with about 7 percent in 1998. A significant subset of that balanced fund category is invested in target date funds.” The report notes that at year-end 2012, 43 percent of the account balances of recently hired participants in their twenties were invested in target date funds, compared with 40 percent at year-end 2011.

401(k) Loan Activity Steady in 2012

The study shows at year-end 2012 that 21 percent of all 401(k) participants who were eligible for loans had loans outstanding against their 401(k) accounts, unchanged from the prior three years (2009−2011), although slightly elevated compared with prior to the financial crisis (2006−2008).

Average 401(k) Account Balance Varies by Participant Age, Tenure, Salary

The EBRI/ICI study also provides a snapshot of the 401(k) account balances at their current employers for the large cross section of 401(k) plan participants in the EBRI/ICI database. Age, tenure, and a number of other factors impact an individual’s account balance at any point in time.

In addition, the 401(k) account balance for an individual’s current job is typically just one of a number of retirement resources that he or she will accrue over a working career, including Social Security.

At year-end 2012, the average 401(k) participant account balance was $63,929 and the median account balance was $17,630, with wide variation reflecting the many variables in retirement saving, including participant age, tenure, salary, contribution behavior, rollovers from other plans, asset allocation, withdrawals, loan activity, and employer contribution rates. Older participants and those with longer tenure tend to have higher 401(k) balances at their current employers. For example, at year-end 2012, the average account balance among 401(k) plan participants in their sixties with more than 30 years of tenure was $224,287.

Information About the EBRI/ICI Database

The full analysis is being published in the December 2013 EBRI Issue Brief and ICI Research Perspective, online at www.ebri.org and www.ici.org/research/perspective. It is based on the EBRI/ICI database of employer-sponsored 401(k) plans, the largest of its kind and a collaborative research project undertaken by the two organizations since 1996. The 2012 EBRI/ICI database includes statistical information on 24 million 401(k) plan participants, in 64,619 plans, holding $1.536 trillion in assets, covering nearly half of the universe of 401(k) participants.

EBRI, established in 1978, is an independent, nonpartisan, nonprofit research and education organization committed exclusively to data dissemination, policy research, and education on economic security and employee benefits. EBRI does not take policy positions and does not lobby.

ICI, founded in 1940, is the national association of U.S. investment companies, including mutual funds, closed-end funds, unit investment trusts, and exchange-traded funds. Members of ICI manage total assets of $16.1 trillion and serve more than 90 million shareholders.