403(b) Plans Offer Diverse Range of Investment Options

New BrightScope/ICI research also shows high employer contribution rate

Washington, DC; December 6, 2018—The average large 403(b) plan subject to the Employee Retirement Income Security Act of 1974 (ERISA) offered 27 “core” investment options in 2015, a joint research study released today by BrightScope and the Investment Company Institute (ICI) has found. Offered by educational institutions, hospitals, and other nonprofit employers, 403(b) plans allow employees to make tax-deferred contributions, often include employer contributions, and offer a wide variety of investments.

“This report suggests that nonprofit employers sponsoring 403(b) plans recognize the importance of plan design and include features that will help attract and retain qualified workers,” said Sarah Holden, ICI senior director of retirement and investor research. “Plan design features, which drive engagement with retirement saving through 403(b) plans, include automatic enrollment, the structure of employer contributions, active and indexed investment options, and the flexibility of a loan feature. With these multiple features, employers are able to customize the design of their 403(b) plans to suit their workforces.”

The study, “The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2015,” examines 403(b) retirement plan design, including automatic enrollment of employees into the plan, employer contributions, and participant loans, as well as investment lineups. The report analyzes 403(b) plans covered by ERISA that had at least $1 million in plan assets and generally had 100 participants or more (large ERISA 403(b) plans).

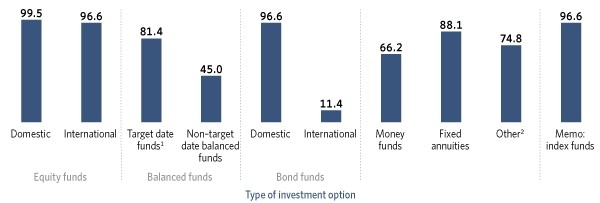

The research found that in 2015, nearly all large ERISA 403(b) plans included domestic equity funds, international equity funds, and domestic bond funds in their core investment offerings. Nearly nine in 10 large ERISA 403(b) plans offered fixed annuities and more than eight in 10 offered target date funds. Other core investments options included non–target date balanced funds, international bond funds, and money funds.

Incidence of Core Investment Options Offered by Type of Investment in Large ERISA 403(b) Plans

Percentage of plans with audited 403(b) filings in the BrightScope database offering the specified core investment option, 2015

1 A target date fund typically rebalances its portfolio to become less focused on growth and more focused on income as it approaches and passes the target date of the fund, which is usually included in the fund’s name.

2 Other includes commodity funds, real estate funds, and brokerage accounts, but each separate option is counted as a unique investment option.

Note: The sample is 3,730 plans with $380.2 billion in assets. Participant loans are excluded. Funds include mutual funds and variable annuities. Audited 403(b) filings generally include plans with 100 participants or more. Plans with less than $1 million in plan assets are excluded from this analysis. Investment options include mutual fund, variable annuity, and fixed annuity options. Core investment options are those that have at least 0.5 percent of plan assets. The funds in a target date fund suite are included if at least 0.5 percent of plan assets are invested in that suite.

Source: BrightScope Defined Contribution Plan Database

Employer Contributions Represent a Significant Portion of Contributions in 403(b) Plans

The study found that the majority of 403(b) plan sponsors had employer contributions. The DOL Form 5500 Research File data indicate that 81 percent of large ERISA 403(b) plans had employer contributions in 2015, up from 74 percent in 2009.

“Employer contributions have grown over time and constitute an important share of total ERISA 403(b) plan contributions, totaling $8 billion, or 29 percent of all contributions, in 2015,” said Brooks Herman, head of data and research at BrightScope. “Often designed as matching contributions, these employer contributions promote retirement saving among employees and encourage them to build a nest egg for the future.”

Other findings about large ERISA 403(b) plans’ investment options and asset allocations include:

- Total plan cost and mutual fund expense ratios have continued trending downward. The BrightScope measure of total ERISA 403(b) plan costs—which includes administrative, advice, and other fees from Form 5500 filings, as well as asset-based investment management fees—has decreased since 2009. In 2015, the average total plan cost was 0.71 percent of assets, down from 0.82 percent in 2009. The study also shows that mutual fund expense ratios in large ERISA 403(b) plans tended to decrease during this time as well.

- Mutual funds were the largest share of plan assets (54 percent) in large ERISA 403(b) plans in 2015. Variable annuities (including variable annuity mutual funds) held 24 percent of assets, and fixed annuities held 22 percent of assets.

- Index funds are widely available in large ERISA 403(b) plans. In 2015, 97 percent of large ERISA 403(b) plans included index funds in their core investment lineups and index funds represented 21 percent of large ERISA 403(b) plan assets.

Target date funds have become more common in large ERISA 403(b) plans. In 2015, 81 percent of large ERISA 403(b) plans included target date funds in their core investment lineups, up from 51 percent in 2009. Target date funds represented 19 percent of plan assets in 2015, up from about 7 percent in 2009.