ICI Quarterly Update, May 2024

ICI-Backed Legislation Breaks Gridlock in Washington

By John Emling, Chief Government Affairs Officer

House Republicans and Democrats recently came together to support American retirement savers and investors by passing three ICI-supported pieces of legislation as part of H.R. 2799, the Expanding Access to Capital Act of 2023, sponsored by House Financial Services Committee Chairman Patrick McHenry.

First, the Increasing Investor Opportunities Act addresses a critical loophole that currently allows activist investors to manipulate closed-end funds (CEFs), jeopardizing the stability and integrity of these investment vehicles. By closing this loophole, this legislation would safeguard the interests of long-term shareholders and ensure the preservation of their investments. Importantly, the legislation would also allow CEFs to have more flexibility in their asset allocation.

Next, the Retirement Fairness for Charities and Educational Institutions Act of 2024 extends investment opportunities to individuals that have 403(b) accounts, such as those working in education, charitable organizations, and public service sectors. This amendment would allow people with these plans to access collective investment trusts, empowering public service and nonprofit employees to maximize their retirement savings and eliminating disparities between public and private sector-backed plans.

And finally, the Improving Disclosure for Investors Act of 2024 modernizes investment disclosures by making electronic delivery, commonly known as e-delivery, the default over paper copies. The vast majority of mutual fund–owning households have internet access and have grown accustomed to paying bills, banking, and managing their finances online. This legislation enhances accessibility while providing investors with the flexibility to opt for paper documents if desired.

This is the first time these pieces of legislation were approved on the House floor. ICI thanks Chairman McHenry, the legislative sponsors, and the members of Congress that supported these amendments for promoting financial security and prosperity across the country. We’re encouraged by the House’s bipartisan spirit and call on the Senate to follow suit and swiftly pass this important legislation.

Worth a Click

|

|

See You There

2024 ICI Leadership Summit: May 21–23 in Washington, DC

Join senior and aspiring leaders from all facets of the asset management industry at ICI’s 2024 Leadership Summit. This fast‑paced conference will take place over two days in the heart of Washington, DC, and will offer unbeatable networking opportunities.

ICI & ASECA: Celebrating 100 Years of the Mutual Fund: May 14 in Austin, TX

Join ICI and the Association of Securities and Exchange Commission Alumni (ASECA) in Austin, Texas, on May 14, 2024, for a unique event bringing together former directors of the SEC Division of Investment Management in celebrating the 100th anniversary of the mutual fund and reflecting on the current issues facing the asset management industry.

Want Daily Updates?

In less time than it takes to fry an egg, you can get a jumpstart on the topics affecting your industry and your job by reading ICI Daily News. Sign up today!

Supporting Members

First-Ever ICI Innovate a Success

In February, ICI brought together the most creative and innovative industry minds at the forefront of asset management’s embrace of technology at the brand new Innovate conference in San Diego. The topic forefront in most members’ minds was AI, and nearly every panel touched on it in some way—how to keep pace with the cutting edge of generative AI and how to harness it toward a clear purpose on behalf of customers. How regulators are responding to technological change in the industry was a hot-button topic, as well, with ICI President & CEO Eric Pan giving an address inviting regulators to act as a partner with our industry in developing a sensible framework for emerging technologies.

2024 Investment Management Conference

This year’s IMC in March was a key forum for forward-thinking compliance professionals and other industry leaders to share their insights and concerns about how to navigate the ever-changing set of rules that govern asset management. This year introduced the Emerging Leaders program, where early-career attendees were able to network and receive mentorship from industry veterans. Other unique touchstones for the 2024 conference included a panel on the impact of judicial decisions on the regulatory process, a panel on AI, and a keynote from ICI President & CEO honoring the 100th anniversary of the mutual fund and looking forward to the progress the industry is set to make in the next century.

An Essential Part of America’s Economic Engine

In honoring the modern mutual fund’s 100th anniversary, ICI has been reminding policymakers about funds’ essential rolein America’s economic success—and the world’s.

This centennial celebration, known as MF100, serves as another opportunity to spotlight the remarkable impact that funds have had on everyday Americans as well as companies big and small. It’s also a chance to underscore to Washington how funds will support America’s dynamism over the next 100 years, from helping to keep US capital markets the envy of the world to building a more inclusive financial future.

As part of our MF100 campaign, we’ve launched a special landing page that features our unique content, upcoming events, and other resources. We’ve also built a toolkit of materials that your firm can leverage, including a special logo, a messaging grid, and social media content, plus additional items that will be added throughout the year.

We invite our members and other market participants to take part in ICI’s campaign celebrating registered funds. If you’re interested in getting involved or becoming a partner of MF100, please email Joe Kon, Director of Special Projects, at joe.kon@ici.org.

Advocating for Investment Funds

Championing the Success of Defined Contribution Plans

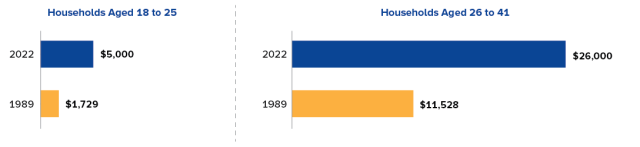

Contrary to some headlines, the long-term financial outlook for Gen Z and Millennials looks promising. According to new ICI research that gained traction in the financial press, that’s due in large part to the increased prevalence of 401(k)s and other defined contribution (DC) plans offering automatic enrollment and an attractive lineup of diversified investments.

Adjusted for inflation, both Gen Z and Millennial households in 2022 had more than twice the assets in their DC plans than same-age cohorts had in 1989—yet another sign that DC plans are working for Americans.

Nevertheless, some lawmakers and academics are seeking to chip away at DC plans, questioning their cost effectiveness and the merits of their tax-advantaged status, among other strained critiques.

ICI is responding forcefully, thus far through a series of op-eds, podcasts, and social media posts, all backed by in-depth research. Through a data-driven approach, we will continue to highlight the many successes of DC plans and work to expand retirement access to more and more workers.

Young Households More Engaged in Retirement Saving Than Gen X Counterparts Were at Similar Ages

Median DC plan assets, in 2022 US dollars, for households with DC plans

Source: ICI tabulations of Federal Reserve Board Survey of Consumer Finances

ESG Fund Rule

At the beginning of March, the SEC finalized public company risk disclosure rules that, in line with ICI’s recommendation, omitted Scope 3 climate impact disclosure requirements. Two weeks later, the Fifth Circuit US Court of Appeals temporarily halted the rules as it reviews challenges to them. On April 8, 2024, ICI submitted a supplemental joint comment letter to the SEC in light of the stay making recommendations for how to make climate disclosure requirements consistent between mutual funds and public companies.

ICI will continue to monitor and keep members apprised of legal developments surrounding the climate risk disclosures.

Enrico Letta Roundtable on EU Savings and Investments Union

In April, Former Italian Prime Minister Enrico Letta released a report, Much More Than a Market, detailing a plan to develop a savings and investments union in the EU—a plan that would unlock €33 trillion in private savings predominately held in currency and deposits. He discussed the report at an ICI roundtable hosted by President and CEO Eric Pan that featured audiences in ICI’s offices in DC and Brussels and others joining virtually via livestream.

The report was the result of more than 400 meetings held in 65 European cities and proposes strategies to modernize the European Single Market, which launched in 1985 when both the EU and the world were smaller, simpler, and less integrated. ICI has been exploring with international policymakers the critical role investment funds should play in channeling household savings into capital markets. Mr. Letta’s plan could provide a critical backbone to modernizing the EU’s approach to funding its ambitious infrastructure plans.

Watch the full roundtable on ICI’s website.

Preserving the Custodial Ecosystem

Through a comment letter, interviews, and a blog that was picked up by the Harvard Law School Forum on Corporate Governance, ICI has continued to warn of the real-world costs to investors if the SEC adopts a proposed expansion of its custody rule. The Commission’s proposed amendments would disrupt the entire custodial ecosystem, driving up costs for investors and reducing their access to professional investment advice. Moreover, basic services that all investors depend on would become more expensive, and liquidity and settlement efficiency in securities markets would weaken.

ICI will continue to educate policymakers on how the custody business operates with the aim of sustaining its benefits to everyday investors.

Calling for Common Sense

The following is adapted from the ICI President’s Address from the 2024 ICI Innovate conference:

From generative AI to blockchain to data science, the rapid pace of technological progress has, understandably, drawn the attention of Washington, DC. Regulators have responded by rushing out new policies, with the goal of keeping investors safe. While these officials are well-meaning, their proposals lack common sense and threaten to grind the wheels of progress to a halt.

A case in point is the SEC’s proposed rule on predictive data analytics. The SEC drafted this rule in response to the rise of artificial intelligence. Chair Gary Gensler has spent much of his career studying technology, and he has major concerns about how it will affect the broader economy. He wants to put a stake in the ground to show that the SEC is taking this danger seriously.

Regrettably, the SEC’s proposal was poorly developed and hastily rolled out. As a result, it will harm far more investors than it protects, if finalized. This rule will dramatically hike costs, hold back the most promising technologies, and hamstring the industry’s efforts to further democratize investing. In fact, it will disrupt almost every aspect of a firm’s operations and interactions with investors, while eviscerating the certainty and stability on which innovators and investors depend.

ICI is leading the way back toward a commonsense approach. We’re advocating a regulatory process that protects investors while promoting the progress that comes with innovation. This shouldn’t be “either/or.” Investors deserve “both/and”—both protection and progress.

This is the message we’re delivering to the SEC and all of Washington. It’s a message of partnership, based on our deep desire to develop the best rules for investors. We’re ready to aid regulators in devising a stronger and more sensible framework for emerging technologies.

In the News

|

|

Any suggestion that this regulatory approach should be changed lacks substantiation and could harm fund investors,” said ICI. “Further discussions on this topic should involve all of the banking regulators and be informed by discussions with the asset management community. |

|

|

[ICI President & CEO Eric J. Pan] said he was pleased the SEC dropped the Scope 3 requirement. Looking ahead to a potential final rule on ESG disclosures for funds and advisors, Pan called on the commission "not to impose greater obligations on funds and their managers than on public companies." |

|

|

"For more than 20 years, U.S. bank regulators have concluded that regulated funds' passivity commitments ensure they do not exercise control over the banks in which they invest," said a spokesperson for ICI. |

|

|

"The ETF market remains fiercely competitive, even as ETFs become increasingly popular with retail investors,” said Shelly Antoniewicz, deputy chief economist at the Investment Company Institute. “According to preliminary data from a forthcoming industry report on fund fees from the Investment Company Institute, overall ETF expense ratios continued to tick down in 2023, for both index and active ETFs," she added. |